Consumer Sentiment: Do Americans See Brighter Days Ahead?

Each month, researchers at the University of Michigan ask hundreds of consumers what they think about present market conditions, the job market, their personal finances and buying intentions, as well as the prospects for the general economy in the future. (Samples are statistically designed to be representative of all American households.) Their answers to about 50 questions are captured in the Index of Consumer Sentiment, which includes the Index of Current Economic Conditions and the Index of Consumer Expectations.

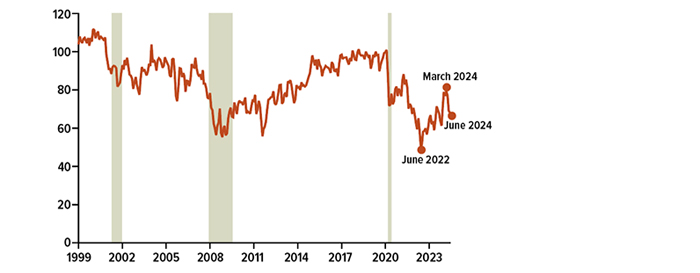

After a long stretch of downbeat readings, this closely watched gauge of consumer confidence turned more optimistic at the beginning of 2024. Between November 2023 and January 2024, the University of Michigan’s Consumer Sentiment Index improved 29%, the biggest two-month increase since 1991. In March 2024, the index reached its highest point since mid-2021 before dipping again over the following three months. Year-ahead inflation expectations dropped from 4.5% to 3.0% over the same period.1

Businesses, investors, and policymakers — including Federal Reserve officials who must determine when and how much to lower interest rates — pay attention to how consumers are feeling, because household spending accounts for more than two-thirds of all U.S. economic activity.2

Perplexing signals

In the past, consumer sentiment has been a reliable indicator of the direction of the economy in the near term, with the index rising during periods of expansion and falling sharply at the beginning of recessions (see chart). Yet, the 2022–2023 readings were out-of-sync with an improving economy.

In June 2022, sentiment reached a record low — worse than readings during the pandemic and the 2007–2009 Great Recession — and they remained weak through most of 2023.3 But after that mid-2022 plunge, real gross domestic product (GDP) growth strengthened and grew a healthy 3.1% in 2023, up from 0.7% in 2022.4 The unemployment rate remained at historically low levels below 4% over the same period.5 The solid labor market supported the 2.7% increase in consumer spending that was the main driver of GDP growth in 2023.6

Why did it take so long for consumers’ outlooks to reflect this positive economic data? Confidence could have been shaken, in part, by a widely forecasted U.S. recession that never came. And many people may have felt uneasy about inflamed geopolitical tensions around the world, including Russia’s war with Ukraine, and/or the contentious political environment in the United States.

University of Michigan Consumer Sentiment Index

Shaded bars indicate periods of recession.

Source: U.S. Bureau of Economic Analysis, 2024

Inflation scars

Another possible explanation for the disconnect between consumer confidence and economic performance is the lingering financial and emotional effects of high inflation. While consumers can breathe a sigh of relief that inflation has retreated (from an annual rate of 9.1% in June 2022 to 3.3% in May 2024), they are still paying much higher prices than they were before the pandemic.7

Plus, the Fed’s interest-rate hikes made borrowing to buy big-ticket items like cars and homes much more expensive, and extreme unaffordability put home ownership out of reach for many Americans. It could take quite some time for consumers to get over their sticker shock and adjust mentally to higher price levels, as well as for their wages and purchasing power to fully catch up to the cost of living.

The confidence surge at the beginning of 2024 coincided with a rising stock market and declining mortgage rates, both of which may have raised consumers’ hopes for the future. And even though consumer sentiment has improved, the index level is still well below the pre-Covid peak in 2020.8

Fed officials and many economists now expect the United States to avoid a recession in 2024, but spending and growth are expected to slow, and unemployment is likely to tick up, as the full impact of high interest rates strains the finances of households and businesses.9 There could also be some unexpected bumps in the road as the Fed works to bring inflation the rest of the way down to its 2% target.