Housing Market Trends: Are They Helping or Hurting the Economy?

In an unusual twist, U.S. home values climbed to an annual record of $389,800 in 2023, even as mortgage rates rose to the highest levels in a generation. The median price of existing homes rose 4.4% for the twelve months ended in December 2023 to reach $382,600. (Buying activity and prices tend to peak during the summer and tick back down when the market slows later in the year.)1

Near the end of October 2023, the average rate for a 30-year fixed mortgage climbed to a 23-year high of nearly 8%, before retreating a bit.2 But despite sky-high borrowing costs, buyer demand exceeded the supply of homes for sale.

As a result, sellers generally fared well, but 2023 was a challenging year for would-be homebuyers.

A market in limbo

Rising mortgage rates and home prices made it harder to afford a home, causing many buyers to be priced out of their favorite neighborhoods and forcing others out of the market altogether. In August 2023, housing affordability dropped to its worst levels since 1985.3

Many people who already own homes have been reluctant to sell and move because they would have to finance their next homes at much higher rates than they currently pay — a conundrum that has worsened the inventory shortage.

This persistent lack of inventory combined with low affordability has cut deeply into home sales. For all of 2023, existing home sales fell to the lowest level in nearly 30 years (4.09 million).4 An estimated 668,000 new homes were sold in 2023, an increase of 4.2% from the previous year, but new construction accounts for less than 15% of the total market.5

Housing and GDP

Housing contributes directly to the nation’s gross domestic product (GDP) in two ways: spending on housing services and residential fixed investment. Housing services include rental payments, imputed rent (the estimated rental value of owner-occupied homes), and utility payments. Residential fixed investment includes new home construction, residential remodeling, production of manufactured homes, and brokers’ fees. In the fourth quarter of 2023, housing accounted for $4.4 trillion of U.S. GDP on a seasonally adjusted annual basis or 15.9% (12.0% for housing services and 3.9% for residential fixed investment).6

New home construction stimulates local economies by creating higher-wage jobs and boosting property tax receipts. Nationally (and locally), it benefits other types of businesses as well, by spurring production and hiring in industries that provide raw materials like lumber or that manufacture or sell building tools, equipment, and home components such as windows, cabinets, appliances, flooring, and fixtures. That’s why the Census Bureau’s report on housing starts — which were up 7.6% from the previous year’s level in December 2023 — is considered a leading economic indicator.7

Home Building Stages a Recovery

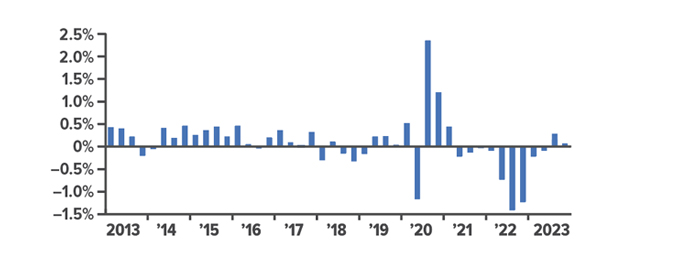

In the third quarter of 2023, residential fixed investment added to U.S. GDP for the first time since Q1 2021. But in Q4, an increase in new residential structures was offset by a decrease in brokers' fees.

Residential fixed investment: contribution to change in GDP

Source: U.S. Bureau of Economic Analysis, 2024

Consumers are the key

The health of the housing market can also affect economic activity in other industries indirectly. For example, the “wealth effect” refers to how shifts in home prices, up or down, can influence consumer finances, confidence, and behavior. When home values and equity are rising, consumers who own homes tend to feel wealthier and may be more comfortable spending their money.

The “transaction effect” describes the increase in consumer spending that typically occurs when people move into new homes, which tends to generate demand for goods and services such as appliances, furniture, electronics, home improvement, and landscaping. On the other hand, extremely low affordability might influence younger consumers in a different way. When buying a home seems unattainable, it may cause them to give up on saving for that goal and shift to spending on other things.

Given housing’s importance to the broader economy, there is some concern that a prolonged period of high interest rates could continue to constrain home building and sales, cause home prices to fall, and damage consumer confidence. When the Federal Reserve begins to cut interest rates, mortgages should gradually follow suit, but that’s not likely to happen until GDP growth slows and inflation is no longer seen as the larger threat.